|

Contact Us |

2436 N Federal Hwy Ste 415

Lighthouse Point, FL 33064

toll free: 877-YACHT LOAN

phone: 954-764-3010

fax: 954-764-0041

|

|

|

PAYING CASH FOR YOUR YACHT?

YOU’RE PROBABLY PAYING TOO MUCH!

Contrary to what many consumers might expect, more and more yacht buyers are finding that a yacht can actually cost less if financed instead of dipping into savings, or selling off assets and paying cash.

According to marine finance expert Jeff Johnson, President of Maritime Finance in Ft. Lauderdale, the advantages of financing, compared to a cash purchase, can be dramatic. “By financing your yacht” says Jeff, “you retain economic flexibility. Your funds can be invested to your advantage, yielding returns that are greater than the cost of your marine financing. So in the end, you come out ahead!”

He adds that yachts may qualify for the same IRS tax advantages that are available for homes, like deductible mortgage interest. “We’ve proven it over and over”, says Jeff, ”your yacht can actually cost less by not paying cash.” Johnson offered the following as an example: using a rate of 5.75% fixed for 20 years on a loan of $100,000, monthly principal and interest payments would be $702.08.

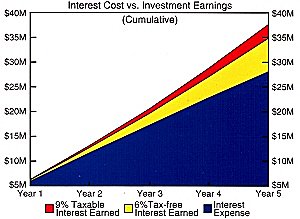

The interest cost of this loan over 60 months would be $26,671.61. However, if you were in the 30% tax bracket, the interest expense deduction could save you $8,001.48 and effectively reduce the cost of the loan to just $18,670.13. This same $100,000 could be invested earning 6.50% growing to $138,281.73 (taxable) in the same period. Tax-free municipal bonds yielding 3.50% could earn $19,094.28 in the same period. And more aggressive investments could obviously make earnings even more attractive. “It’s easy to see how financing your yacht could cost you less”, says Jeff.

Yacht buyers who are interested in finding out more about costs, savings and tax advantages of marine financing, can contact Jeff Johnson of Maritime Finance toll free at 877-Yacht Loan (922-4856) or visit their web site eYachtLoan.com. Maritime Finance’s key personnel are seasoned yacht finance professionals. “You might say that we’re yachter friendly”, says Johnson, noting that a number of Maritime’s employees are very involved in yachting.

MAYBE YOUR SECOND HOME SHOULDN’T BE A SECOND HOME

Your yacht may qualify for the same IRS tax advantages that are available for a second home, like deductible mortgage interest. And by financing your purchase, instead of liquidating assets or paying cash, you increase your financial flexibility. This enables you to take advantage of attractive new investment opportunities as they come along... and the earnings from these investments can easily exceed the cost of your marine financing. In the end, your yacht may cost less by not paying cash. See IRS Publication 936.

To learn more about the advantages of yacht financing, please call us at 877-Yacht Loan.

And remember… if you're paying cash, you're probably paying too much! |